Introduction: The housing market in Beijing is facing major changes ahead. The average age of first-time home buyers is now 34, which is roughly a year later than before. And this trend doesn’t show any signs of turning around in the future.

As Beijing’s population expands from people moving to the city to work or live, it’s becoming increasingly more difficult to purchase a home. Demand is high and so are housing prices. In this market, it’s making more and more sense for consumers to turn towards home rentals.

1.Future Population: The question that is being heavily debated is whether or not an increase in home rentals would lead to a drop in housing prices. There are some key facts that are important to consider.

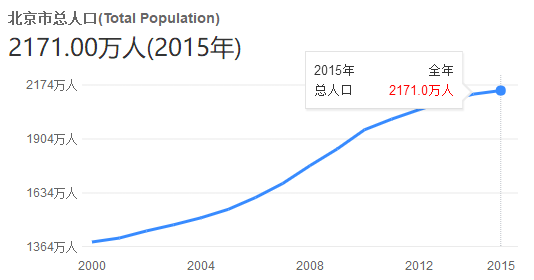

Graph: Beijing’s population growth between 2000 and 2015.

First, population is highly correlated with housing prices. National data shows that there are about 700 million people currently living in China’s urban areas. In the next few years this number is expected to expand to about 900 million – 1 billion. Analysts also believe that the future population will be concentrated in just 20 cities across China.

Already, an urban population of 700 million has put pressure on the housing market. How will the market respond when the number is 1 billion? Even in third tier cities, where the population is flowing out towards larger cities, there is still a trend of increasing centralization in city centers.

Even if the market turns towards home rentals, the opposing strain from population migration towards city centers will be a strong factor in housing prices.

2. 1/3 of People to Rent: The second question on everyone’s mind is what the ratio of renters to buyers will be in the future. Current data suggests that 21% of consumers will rent and 80% will buy.

In Beijing specifically, one-third of the population is already renting rather than buying. Although the majority of people are still living in purchased homes, the rental market forecast suggests that there will be a rising preference towards renting in the coming years.

In other major international cities, such as New York or Hong Kong, over 50% of residents are renting their home. Beijing is expected to follow in this direction as well.

3. 10 million Home Rentals in Future: The third question is about the basic situation of the rental market itself in the future. In Beijing the current resident population is about 22 million. And the housing market? There are only 7 million housing units. The number of housing units relative to the number of households is 0.85-0.9. That is to say, the average home per a household, is less than one house. There is a real estate shortage in Beijing. The average level in China is around 1.05. In third tier cities this number is about 1.2 or so.

It’s simply not possible for each and every household in Beijing to purchase their own home. The expected increase in Beijing’s population in the coming years will also further strain the supply. Traditionally, Chinese consumers have favored buying over renting. However, market conditions are sparking a shift amongst residents. Savvy shoppers are starting to see renting as the better option.

Even so, there is a huge gap between supply and demand. Beijing’s home rental market is dominated by one- and two-bedroom apartments, which take up about 87% of the market. In the future, there will be an estimated 10 million people renting their home. This means that Beijing will need 200 million sqm worth of rental space. Today, Beijing only has about half that amount. How will the market fill this gap?

4. The Time of Rapid Growth is Over: Overall, the data suggests that the time of rapid growth in housing prices is over. There is multi-stage trend that cities across the world usually follow. When per capita GDP is over $1,400, new investment in real estate begins to rise. This is the beginning.

When per capita GDP exceeds $3,000, the amount of new investment begins to rise rapidly, along with property prices. However, when per capita GDP hits $8,000, the amount of new investment in real estate levels off and housing prices stabilize.

In 2008, China’s per capita GDP was $3,000, and by 2015 it had reached that $8,000 benchmark. And there have been no market indicators predicting that China will deviate from the norm. Based on this, it is believed that the time of continual, steep growth in real estate prices is over.

5. The Future of Rental Prices: What is the most important variable when looking at rental prices? The price of rent is not strongly connected to the price of the property itself. One strong factor, however, is the per capita income in a given city. As long as per capita income is rising, housing rental prices will also rise.

If you look at Beijing, for example, the rate of increase is very stable. Every year it rises just a little each year. In the past year or so, it even fell a bit. Meaning, rental prices have been rising in a very steady, predictable way.

Is rent in China expensive today? If you compare rental prices per square meter in Beijing and Tokyo, rental prices appear to be relatively cheaper and more affordable in Beijing. In general, the percent of personal income that is spent on rent is about 30-40% in Beijing.

Although demand is expected to shoot up over the next few years, adding pressure to the market, there will likely be some consumer benefits. Namely, housing quality and options will rise as well, giving tenants more choices. In the short-term this will be a win-win situation for all sides.